When I was a student at university, I managed to keep myself out of debt by working part-time jobs and by doing paid internships, which was a great way for me to build up experience. However, even though I didn’t accumulate debt during this period of time, money was still pretty tight. At the end of the month and at the end of the year, I would have more or less the same amount of money I started out with. This is a great situation to be in as a student, but it also meant that sometimes I didn’t have enough money to pay the bills. An unexpected bill such as a parking ticket might have meant something else would need to be cut that week, at least until the next paycheck would arrive. I was living paycheck to paycheck, which while being much better than being in debt, was still not a good situation to be in.

The problem of course is that my expenses were too high. I was making a low salary, but living as if I made a higher salary. I was not leaving a surplus on the side to carry me over the lean days.

What happens if you carry on the same habits, year after year?

I personally know two families; for anonymity’s sake let’s call them the Blake family and the Dodge family. Here are their stories:The Blakes

The Blake family are a group of first-generation immigrants. They immigrated from a place where living conditions were a little harder, and opportunities a little harder to come by. They are enjoying their new home, and stashing away most of their income. They don’t spend a lot of money on eating out at restaurants or on other things that can cut over time, but they do save up to take the family on the occasional family vacation every now and then. They look for extra opportunities to make money when it makes sense, such as paid overtime.By the time the little Blakes have grown up and left the home, the Blakes are nearly ready to retire. They still live in the same home, paid off long ago. They still work hard even though they are nearing retirement age. They haven’t gone on as many trips or spent that much during their live, but the trips they did go on were memorable and excellent. They’ve been able to provide for their family and have a nest egg to last them the rest of their lives. Some would say that the Blakes are fortunate, and indeed they are, but they also positioned themselves to be in a good place to take advantage of this good fortune!

The Dodges

The Dodges also have an immigrant heritage, but unlike the Blakes they are actually a second-generation family. They have experienced the benefits of growing up in a wealthy country, and their parents did everything they could to ensure they didn’t experience any hardship. The Dodges want to experience more freedom than their parents had, and they see money as a tool to be used to experience life in the moment; they often go on trips to the Caribbean, purchase a lot of jewellery, and they don’t hesitate to live it up when the occasion calls.Before I go on, let me be clear that there’s nothing wrong with the Dodges choosing to live their life a bit differently. They also love their family, and they are not better or worse people. There is a difference though: the Dodges simply have a different weighting of the present versus the future.

Things go on like this for a while, but the Dodges become overleveraged over time. Instead of paying off their home, they add a second mortgage. Paycheck to paycheck living eventually turns into debt-based living. When the economy grows lean one year, they are no longer able to afford the payments and lose the home. The Dodges are forced to move to an apartment, and the kids stay at home to help out with the rent payments.

They are no longer in debt, but without savings, they are forced to live an austere life. The Dodges are entering a time in their lives when they should be able to sit back and breathe a bit, but unfortunately they now have to work extra-duty to make up for all of the spending in the previous years. Some would say that the Dodges are unlucky, and in a way they are, but they also did not position themselves to be in a better position to ride out the lean years.

Savings = freedom

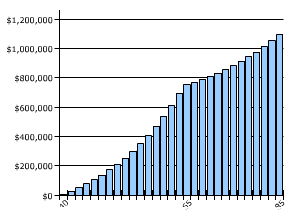

Being out of debt is good, but the only way we really improve our lot in life is by saving and investing for the future! This is true both individually, and of us as a whole. The Dodges have it rough, but they are doing great compared to people a hundred years ago. They are able to indirectly benefit from the accumulated savings and investment of other people which has led to all of the things in society which we enjoy today.When we save & invest, it’s selfish in the sense that we want to improve our own lives, but we actually help out everyone just a little bit at the same time, and when a lot of people are saving & investing, these effects lead to everyone being better off down the road.

The Dodges fell into the trap of lifestyle inflation, and their expenses grew faster than their income. They enjoyed life while the times were good, but everything moves in cycles and you need to be prepared for the leaner parts of those cycles. At least without debt, there is a chance for the Dodges; they lost everything, but they also have a shot at a fresh start.