Starting today, I will be posting a series of computation method related to time value of money on every Wednesday. Today, we will learn to find the rate of return required to meet a financial goal.

Common Problems

- You have set aside RM10,000 for your future dream home down payment. You want to have at least RM15,000 after 5 years time to purchase your dream house. What is the rate of return required if you were to invest the initial RM10,000 in order to get RM15,000, 5 years later?

- You invested RM5,000 in a balanced unit trust fund that gives an average of 10% return per annum. How long you must keep the money invested in order to have RM10,000 to fund your child’s tertiary education?

Theory

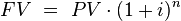

Use this formula:PV (Present value) = present sum of money set aside for the investment

i = rate of interest/rate of return

n = number of periods

It can be modified to determine the rate of return required. In this case, we know the value of FV, PV and n. What we want to compute is i.

You can use the interpolation method or the trial and error method using excel spreadsheet. But I would prefer the easiest route using financial calculator.

Use this Financial Calculator provided by Money Chimp

Solutions

Example 1:You have set aside RM10,000 for your future dream home down payment. You want to have at least RM15,000 after 5 years time to purchase your dream house. What is the rate of return required if you were to invest the initial RM10,000 in order to get RM15,000, 5 years later?

PV = RM10,000

FV = RM15,000

n = 5 years

i= ?

i = 8.45%

Example 2:

You invested RM5,000 in a balanced unit trust fund that gives an average of 10% return per annum. How long you must keep the money invested in order to have RM10,000 to fund your child’s tertiary education?

PV = RM5,000

FV = RM10,000

i = 10% p.a.

n = ?

Use this financial calculator:

Input the value as shown in the image above. Click NP.

n = 7.27 years

No comments:

Post a Comment