Fund for Blog Development-Please click

Sunday, May 1, 2011

NusaWorld: Bankruptcy: Not a Personal Choice

NusaWorld: Bankruptcy: Not a Personal Choice: "W hy or how do people become bankrupts? Obviously these people have a debt management problem. Personally, I believe problems dealing wi..."

How to pay off your credit cards debt

The number one financial problem is bad debt. You see, bank lend you money to buy the stuff that you can’t afford yet. For example, you borrow money to buy car, house, or to use the money as capital in your businesses. The problem rises when you misuse the financing facilities to buy the wrong stuff.

In this article, I am going to discuss the three most important things that may change your view about using credit card as a financing tool. Discover the three most important understanding that will help you cope with your credit card debt (if you have any)

Majority of people finance their instant gratification on credit card. That significantly increases their spending which is on credit. Do it often enough, you will have trouble paying back the money you spent on credit card.

So the first concept you must understand is that it is fine, or even great to buy stuff with borrowed money, only if those are assets.

The first step is to just cultivate a new habit. That is to delay all your wants, and luxuries. Don’t ever think of it if you are still in debt. You can’t allow yourself to keep spending money like there is no tomorrow.

There are only two ways to have more money now. The first one is to cut your current expenses drastically. If you are living on RM2000 fixed expenses a month, cut it instantly down to whichever number you can live with. Start by 10% cut, then another 10% …and try slashing some items again when you are already in comfort zone.

By the time you had settle the outstanding credit card amount, you’ve already build yourself a new habit of living below your means.

At the same time, one further step to take is to find ways to increase your income. Effort is always needed to make more money. But it is worth the time you spend on it.

With all these extra money you find, you shall be able to make extra payment to the debt and got yourself out of the mess really soon.

In my MA$ course, I show how to have a debt paying system in place. You may be interested to find out more about it if you are having trouble with credit card debt now

In this article, I am going to discuss the three most important things that may change your view about using credit card as a financing tool. Discover the three most important understanding that will help you cope with your credit card debt (if you have any)

Bad debt makes you poor

Rich people use debt to finance their assets purchase. That kind of debt is called good debt by Robert T. Kiyosaki. Poor people borrow money to finance their vacations, gadgets and all sorts of expense-generating possessions.Majority of people finance their instant gratification on credit card. That significantly increases their spending which is on credit. Do it often enough, you will have trouble paying back the money you spent on credit card.

So the first concept you must understand is that it is fine, or even great to buy stuff with borrowed money, only if those are assets.

Delay gratification: make it into a habit

When you are deeply in debt, the most significant habit that you should cultivate is delay gratification. You see, when you don’t have a specific good habit, which means you are having the opposite bad habit. When you have the habit of wanting instant gratification, it means you don’t have the discipline to delay gratification.The first step is to just cultivate a new habit. That is to delay all your wants, and luxuries. Don’t ever think of it if you are still in debt. You can’t allow yourself to keep spending money like there is no tomorrow.

Cut expenses drastically and get extra income

After getting into the new habit of delay gratification, it means that you no longer incur additional debt. Now you will need to find extra money to settle your credit card debt.There are only two ways to have more money now. The first one is to cut your current expenses drastically. If you are living on RM2000 fixed expenses a month, cut it instantly down to whichever number you can live with. Start by 10% cut, then another 10% …and try slashing some items again when you are already in comfort zone.

By the time you had settle the outstanding credit card amount, you’ve already build yourself a new habit of living below your means.

At the same time, one further step to take is to find ways to increase your income. Effort is always needed to make more money. But it is worth the time you spend on it.

With all these extra money you find, you shall be able to make extra payment to the debt and got yourself out of the mess really soon.

In my MA$ course, I show how to have a debt paying system in place. You may be interested to find out more about it if you are having trouble with credit card debt now

How to organize your file system?

As time goes by, you get more documents to organize. It is mostly due to the more assets you acquire. It is the same when you acquire more liabilities. You get more statements whenever you deal with banks, buy a house, start a business etc.

There will be a time when you feel overwhelmed by all the papers, receipts, documents, catalogues, magazine etc. Those clutters make your life complicated.

Here, I am going to show you how I deal with these. You may not agree with my methods because you may already had a filing system that’s working fine at this moment. Read on to find out how I reduce the amount of papers in my working space. These are the three principles I hold on to when it comes to organizing my files.

Here, I am going to show you how I deal with these. You may not agree with my methods because you may already had a filing system that’s working fine at this moment. Read on to find out how I reduce the amount of papers in my working space. These are the three principles I hold on to when it comes to organizing my files.

When things are stored in digital form, you can send them out easily by email. Whenever you need a hardcopy, it is just as easy as hitting the print button.

By getting online, you can get a lot of documents on digital form at the first place. The most frequent documents sent by post are banking statement such as credit card and mortgage statements. Some banks even force their customer to receive e-statement nowadays, which is really great for the environment and also to simplify your life.

By getting online, I also mean that you should save your document online. The one that I use is Evenote.com. Of course there are many other alternative but I just got used to Evernote because of their iPhone and iPad app. I email files, photos and even short videos to my Evernote and Gmail account.

The most important feature is the powerful search function.

There will be a time when you feel overwhelmed by all the papers, receipts, documents, catalogues, magazine etc. Those clutters make your life complicated.

Do you see these files piling up in your work space?

Go digital

The first step to make your filing system easy to manage is to reduce the amount of paper you need to keep. The most effective way to reduce paper is to go digital. Simply scan the important documents and store them in your computer.When things are stored in digital form, you can send them out easily by email. Whenever you need a hardcopy, it is just as easy as hitting the print button.

Go online

After getting most things in digital form, it is now time to get online. Storing files locally in your computer bear a risk. Whenever your hard disk crash, all copies will be gone permanently. No matter how many backup you made on CD or thumb drive, there will be events that destroy all your stuff. For example, think of flood and fire.By getting online, you can get a lot of documents on digital form at the first place. The most frequent documents sent by post are banking statement such as credit card and mortgage statements. Some banks even force their customer to receive e-statement nowadays, which is really great for the environment and also to simplify your life.

By getting online, I also mean that you should save your document online. The one that I use is Evenote.com. Of course there are many other alternative but I just got used to Evernote because of their iPhone and iPad app. I email files, photos and even short videos to my Evernote and Gmail account.

The most important feature is the powerful search function.

Bankruptcy: Not a Personal Choice

Why or how do people become bankrupts? Obviously these people have a debt management problem. Personally, I believe problems dealing with debt or money stems from not having proper knowledge or education on money management. Put simply, due to the lack of financial literacy.

We currently live in the Information Age where news and information travel lightning fast and knowledge can be found at our fingertips just by tapping to the World Wide Web. Anyone can expand his knowledge or education if he takes the initiative and make the effort to do so. Financial knowledge is especially important as it has a significant impact on a person’s future wellbeing.

Nowadays, people are generally aware that good money management is important for personal success. Parents are teaching and imparting useful money lessons to their children to ensure they have good money habits. From exchanging ideas and communicating with other people, I have come to the conclusion that generally people have a good basic knowledge of proper money management.

For example, saving part of their income, investing their money to get a good return, living within their means, having multiple sources of income, etc. However, as enlighten as we are about money, we still mismanage our finances. In Malaysia, the number of bankruptcy cases continues to rise instead of going down. In addition, the debts involved are also bigger. From January to June this year, about 9000 borrowers who declared bankruptcy accumulated about RM12.4 billion of bad debts. This figure has surpassed the amount of bad debt incurred in 2009 where 16,228 individuals racked up RM9.28 billion of debts.

The bankrupts include those who defaulted on housing, personal, vehicle and business loans and also on credit card payments. Believe it or not, the current year(2010) statistics show that about 500 people are declared bankrupt monthly due to unserviced car loans. The figure is higher compared to the average of cases in 2009 (330 cases a month), 2008 (227 cases a month) and 2007 (265 cases a month).

I have come to the conclusion that a person can become a bankrupt due to various circumstances and not just from the lack of financial knowledge alone. For example, the circumstances can be the lacked of knowledge or experience, an investment or business gone badly, ill health, a job loss, the death of a partner, etc. It could be one or a few negative circumstances happening simultaneously.

What are your personal opinions on why people become bankrupt?

We currently live in the Information Age where news and information travel lightning fast and knowledge can be found at our fingertips just by tapping to the World Wide Web. Anyone can expand his knowledge or education if he takes the initiative and make the effort to do so. Financial knowledge is especially important as it has a significant impact on a person’s future wellbeing.

Nowadays, people are generally aware that good money management is important for personal success. Parents are teaching and imparting useful money lessons to their children to ensure they have good money habits. From exchanging ideas and communicating with other people, I have come to the conclusion that generally people have a good basic knowledge of proper money management.

For example, saving part of their income, investing their money to get a good return, living within their means, having multiple sources of income, etc. However, as enlighten as we are about money, we still mismanage our finances. In Malaysia, the number of bankruptcy cases continues to rise instead of going down. In addition, the debts involved are also bigger. From January to June this year, about 9000 borrowers who declared bankruptcy accumulated about RM12.4 billion of bad debts. This figure has surpassed the amount of bad debt incurred in 2009 where 16,228 individuals racked up RM9.28 billion of debts.

The bankrupts include those who defaulted on housing, personal, vehicle and business loans and also on credit card payments. Believe it or not, the current year(2010) statistics show that about 500 people are declared bankrupt monthly due to unserviced car loans. The figure is higher compared to the average of cases in 2009 (330 cases a month), 2008 (227 cases a month) and 2007 (265 cases a month).

A person’s age

Does a person’s age play a role? The older you get, the better you become at managing your money and debt, right? Wrong! According to the data provided by AKPK and published in the September 2010 issue of Personal Money Magazine, people over age 30 and 40 are more liable to having debt management problems compared to their younger counterparts.I have come to the conclusion that a person can become a bankrupt due to various circumstances and not just from the lack of financial knowledge alone. For example, the circumstances can be the lacked of knowledge or experience, an investment or business gone badly, ill health, a job loss, the death of a partner, etc. It could be one or a few negative circumstances happening simultaneously.

What are your personal opinions on why people become bankrupt?

How to Achieve Financial Freedom

financial freedom is definitely not a myth. Although it remains as a dream for most people who are still struggling and running in their own rat race, financial freedom is just a state when some numbers are met. The good news is that every one of us has different set of numbers to meet.

It is commonly known that when the passive income is more than enough to cover the required expenses, you are financially free. Based on this formula alone, it is enough to show that FF can be achieved in many different ways.

If you sell all your stuff such as house, vehicles and all other belongings, you are almost financially free if you are a single working adult. Move to a place where everything is still cheap, and you are okay to live cheap and stay cheap, you got your financial freedom almost instantly.

Look at the formula again. On the other hand, it seems more fun to have a high passive income level that enables you to afford a more luxurious lifestyle. Isn’t that most people are chasing after in their rat race?

Besides measuring FF with your passive income, which most people don’t have, you can also measure FF in terms of “time”. The formula works this way – calculate how much money you had accumulated, and divide it by the monthly required expenses to sustain your lifestyle.

That number represents how many months you can survive without additional inflow of money. If you are 50 years old and you spend RM1000 a month, you only need RM360,000 to achieve FF assuming you will live up to 80 years old.

So even if you do nothing to increase passive income, you can still accumulate enough money to stop working.

But most people are simply lost in the rat race of chasing after FF dreams. Some people want to be able to stop working on their boring jobs. They thought that financial freedom is the only way out.

Let me ask you this question – why do you want to achieve FF?

So that you can stop working?

So that you can have enough money to spend?

So that you can travel the world?

The ultimate answer I can think of is that you want to do whatever you want without worrying about money, right?

So can I conclude that what you actually want is the freedom of time and location, more than money? You want time freedom and location freedom rather than financial freedom, am I right? Money is just a way to get you there.

It is commonly known that when the passive income is more than enough to cover the required expenses, you are financially free. Based on this formula alone, it is enough to show that FF can be achieved in many different ways.

Passive income > expensesYou can either reduce your expenses or increase your passive income. The problem is most of us can’t compromise on a lower spending.

If you sell all your stuff such as house, vehicles and all other belongings, you are almost financially free if you are a single working adult. Move to a place where everything is still cheap, and you are okay to live cheap and stay cheap, you got your financial freedom almost instantly.

Look at the formula again. On the other hand, it seems more fun to have a high passive income level that enables you to afford a more luxurious lifestyle. Isn’t that most people are chasing after in their rat race?

Besides measuring FF with your passive income, which most people don’t have, you can also measure FF in terms of “time”. The formula works this way – calculate how much money you had accumulated, and divide it by the monthly required expenses to sustain your lifestyle.

That number represents how many months you can survive without additional inflow of money. If you are 50 years old and you spend RM1000 a month, you only need RM360,000 to achieve FF assuming you will live up to 80 years old.

So even if you do nothing to increase passive income, you can still accumulate enough money to stop working.

But most people are simply lost in the rat race of chasing after FF dreams. Some people want to be able to stop working on their boring jobs. They thought that financial freedom is the only way out.

Let me ask you this question – why do you want to achieve FF?

So that you can stop working?

So that you can have enough money to spend?

So that you can travel the world?

The ultimate answer I can think of is that you want to do whatever you want without worrying about money, right?

So can I conclude that what you actually want is the freedom of time and location, more than money? You want time freedom and location freedom rather than financial freedom, am I right? Money is just a way to get you there.

How you can increase financial literacy with minimum effort

Personal finance is a very big topic. You can say that anything that got to do with money is personal finance. You probably got your first financial lesson from your parents, who handed you the first dollar to spend.

For me, I’ve personally learned about financial stuff through many ways. My parents are not affluent. The biggest lesson I learned from them is to live frugally and always spend less than I earn. As I was studying in university, I started to pick up books on personal finance niche and later on got myself involved professionally in this field.

Now the question is how do you learn more about this topic? And what is the method you can apply to improve your financial literacy?

Let’s start with something easy and free. With the growth of the Internet and the number of websites, you get to connect to the “net” practically anywhere anytime. Coupled with the growth of Google, you can pretty much search a lot of free information out there.

Some people say that knowledge is power and now information is freely available when more internet users are sharing ideas and making more in-depth discussion. It is really convenient to find info. But the problem of information overload arises.

Other than this, you can also ask the people around you for free advice.

When info is free, who is going to judge whether the info is valid or not?

It is also how you organize the info that determines whether it is practical and valuable.

So as people are overwhelmed with free load of info, many had chosen to pay for organized information. So you buy books, pay to attend seminars and workshops and even online courses. You are willing to pay so that you can access the trusted content easily, conveniently and ultimately learn in a more organized way.

Believe it or not, the best or more often the biggest financial lesson learned is through personal experience. I call this the expensive way because you simply can’t expect to get everything right at the first attempt. Some mistakes are really costly.

Think of your first time buying a public listed company share. Think of the your very first property purchase. Imagine the hassle of starting your first business. And I still remember vividly the moment I earned the first dollar online.

I’ve made mistakes along the way. Some cost money. Some cost me time which is impossible to be recovered. What I gain through the mistake is valuable experience. Now I know and learned that there are many ways that doesn’t work.

So what do you think is the best method to learn about personal finance? Should you rely on free info? Should you pay for premium access? Should you just do it and learn from mistake?

The answer is that it all depends on your resources of time and money.

When you don’t have much money, normally for those who just started out, you will prefer to search for free info. If that info is not available, at most you are going to buy books, a report or something similar that’s affordable.

As you progress, you will find that you actually lack the time to try everything. Then you will start appreciate the premium content experts put effort into creating. You will then justify that paying money to attend seminar and courses are worth the time it saves you.

After all, we are willing to pay for getting the return of more time and money, don’t we?

The older you get, the less mistakes you can afford to make.

For me, I’ve personally learned about financial stuff through many ways. My parents are not affluent. The biggest lesson I learned from them is to live frugally and always spend less than I earn. As I was studying in university, I started to pick up books on personal finance niche and later on got myself involved professionally in this field.

Now the question is how do you learn more about this topic? And what is the method you can apply to improve your financial literacy?

Let’s start with something easy and free. With the growth of the Internet and the number of websites, you get to connect to the “net” practically anywhere anytime. Coupled with the growth of Google, you can pretty much search a lot of free information out there.

Some people say that knowledge is power and now information is freely available when more internet users are sharing ideas and making more in-depth discussion. It is really convenient to find info. But the problem of information overload arises.

Other than this, you can also ask the people around you for free advice.

When info is free, who is going to judge whether the info is valid or not?

It is also how you organize the info that determines whether it is practical and valuable.

So as people are overwhelmed with free load of info, many had chosen to pay for organized information. So you buy books, pay to attend seminars and workshops and even online courses. You are willing to pay so that you can access the trusted content easily, conveniently and ultimately learn in a more organized way.

Believe it or not, the best or more often the biggest financial lesson learned is through personal experience. I call this the expensive way because you simply can’t expect to get everything right at the first attempt. Some mistakes are really costly.

Think of your first time buying a public listed company share. Think of the your very first property purchase. Imagine the hassle of starting your first business. And I still remember vividly the moment I earned the first dollar online.

I’ve made mistakes along the way. Some cost money. Some cost me time which is impossible to be recovered. What I gain through the mistake is valuable experience. Now I know and learned that there are many ways that doesn’t work.

So what do you think is the best method to learn about personal finance? Should you rely on free info? Should you pay for premium access? Should you just do it and learn from mistake?

The answer is that it all depends on your resources of time and money.

When you don’t have much money, normally for those who just started out, you will prefer to search for free info. If that info is not available, at most you are going to buy books, a report or something similar that’s affordable.

As you progress, you will find that you actually lack the time to try everything. Then you will start appreciate the premium content experts put effort into creating. You will then justify that paying money to attend seminar and courses are worth the time it saves you.

After all, we are willing to pay for getting the return of more time and money, don’t we?

The older you get, the less mistakes you can afford to make.

4 cara mudah membuat simpanan

1)Gantikan hiburan kepada aktiviti reakreasi.

Anda boleh menggantikan aktiviti hiburan seperti movies, shows, teater dan theme park kepada aktiviti rekreasi yang lebih murah berbabding aktiviti hiburan yang berkos tinggi dan memberi kepuasan sementara sahaja (beberapa jam atau sehari). Jadi, jomlah kita bersiar-siar di taman permainan dengan keluarga di petang hari. Sambil kita sumai isteri dapat berdua-duaan di kerusi panjang, anak-anak pula riang ria bermain gelongsor.

2) Jauhi pusat membeli belah / shopping mall dan specialty shop

Memang susah nak elak betul tak? Kebarangkalian untuk kita membeli barang yang tiada dalam senarai sangat tinggi bila sampai shopping mall. Sampai-sampai pintu masuk dah ada salesman approach suruh beli barang itu ini, belum lagi dengan pelbagai banner promosi ’sales’ sana sini. Huhu, kalau goyah, maunya lebih 5 kali swipe kad kredit tu.

3) Tetapkan matlamat simpanan anda!

Letakkan matlamat pada setiap matlamat anda. Sebagai contoh, untuk menunaikan ibadat haji, Orang dah biasa cakap, matlamat kita mestilah SMART (specific, measurable, achievable, realistic and can be accomplished on a timed basis). Bila anda dah mulakan simpanan tetap, lama-lama anda dah biasa dengan habit tersebut dan anda semakin rasa enjoy! Tak percaya? Cuba mulakan langkah anda hari ini!

4) Kurangkan perbelanjaan dan jangan buat hutang

Mungkin kita boleh kurangkan perbelanjaan kat mana-mana yang patut. Paling mudah, kita boleh naik public transport ke pejabat dan bawa bekal ke pejabat. Kadang-kadang jika tiada urusan, ada juga saya selang seli menggunakan public transport dan membawa bekal. Ternyata sejumlah RMXXX dapat dijimatka

Anda boleh menggantikan aktiviti hiburan seperti movies, shows, teater dan theme park kepada aktiviti rekreasi yang lebih murah berbabding aktiviti hiburan yang berkos tinggi dan memberi kepuasan sementara sahaja (beberapa jam atau sehari). Jadi, jomlah kita bersiar-siar di taman permainan dengan keluarga di petang hari. Sambil kita sumai isteri dapat berdua-duaan di kerusi panjang, anak-anak pula riang ria bermain gelongsor.

2) Jauhi pusat membeli belah / shopping mall dan specialty shop

Memang susah nak elak betul tak? Kebarangkalian untuk kita membeli barang yang tiada dalam senarai sangat tinggi bila sampai shopping mall. Sampai-sampai pintu masuk dah ada salesman approach suruh beli barang itu ini, belum lagi dengan pelbagai banner promosi ’sales’ sana sini. Huhu, kalau goyah, maunya lebih 5 kali swipe kad kredit tu.

3) Tetapkan matlamat simpanan anda!

Letakkan matlamat pada setiap matlamat anda. Sebagai contoh, untuk menunaikan ibadat haji, Orang dah biasa cakap, matlamat kita mestilah SMART (specific, measurable, achievable, realistic and can be accomplished on a timed basis). Bila anda dah mulakan simpanan tetap, lama-lama anda dah biasa dengan habit tersebut dan anda semakin rasa enjoy! Tak percaya? Cuba mulakan langkah anda hari ini!

4) Kurangkan perbelanjaan dan jangan buat hutang

Mungkin kita boleh kurangkan perbelanjaan kat mana-mana yang patut. Paling mudah, kita boleh naik public transport ke pejabat dan bawa bekal ke pejabat. Kadang-kadang jika tiada urusan, ada juga saya selang seli menggunakan public transport dan membawa bekal. Ternyata sejumlah RMXXX dapat dijimatka

Dana kecemasan atau Bayar Hutang?

Lepas baca entry Dana Kecemasan minggu lepas, ada yg dah mula menabung. Tapi persoalannya, hutang pon ada. Jadi, yg mana patut didahulukan?

Banyak faktor yg mempengaruhi. Antaranya faktor kepentingan/kesesakan peminam wang, simpanan sedia ada penghutang, kestabilan kerja dll. Sebaiknya jika hutang yang kecil seperti kepada kawan etc, dan kebetulan anda ada wang lebih disebabkan mengurangkan perbelanjaan lain ie makan luar, jadi bayarlah hutang kepada kawan dulu.

Dave Ramsey mencadangkan supaya setiap individu sebaiknya membuat 1) Dana kecemasan dahulu dan 2) Diikuti membayar hutang. Yelah..hutang rumah dan kereta, takkan habis dalam masa yg singkat kan?

Bagi saya, kedua-duanya sama penting. Jadi, terpulang kepada anda strategi apa yg akan anda gunakan. Yang pastinya, kita memerlukan displin, komitment and azam untuk memastikan kedua-dua komitmen kewangan tersebut terlaksana. Pada waktu yg sama, jgn pula sewenang-wenang menambah hutang sedia ada.

Kurangkan perbelanjaan yang tak patut dan hidup berjimat cermat juga boleh membantu kita membayar hutang dan membuat dana kecemasan

Kurangkan perbelanjaan yang tak patut dan hidup berjimat cermat juga boleh membantu kita membayar hutang dan membuat dana kecemasanSaya suka menolak ( secara baik) setiap salesman/bankman yang approach utk buat hutang peribadi mahupun kad kredit. Maaf yer! :D Wrong no plss

Wednesday, February 2, 2011

Dana Kecemasan: perlu sangat ker?

Penah dengar tentang Dana Kecemasan? Pasti pernah bukan. Jadi, anda sudah ada ker Dana Kecemasan?

Dana kecemasan ni bermaksud satu dana dimana anda memerlukan wang di saat-saat kecemasan atau tidak diduga/tidak disangka. Contohnya:

- Anak jatuh sakit dan memerlukan perbelanjaan utk rawatan kesihatan

- Kereta anda tiba-tiba tanyarnyer meletup

- Bumbung rumah tiba-tiba rosak / berlubang

- Syarikat bekerja bankrup dan kita dibuang kerja

- Dan sebagainya

Bagi saya ianya bergantung kepada jumlah perbelanjaan bulanan anda. Dan juga dipengaruhi dengan faktor lain seperti kestabilan pekerjaan dan tahap risiko kredit anda ( maksudnya lg banyak hutang, lagi tinggi risikonya).

Walaubagaimanapun, pakar kewangan biasanya menasihatkan untuk kita mempunyai Dana Kecemasan antara 3 hingga 6 bulan perbelanjaan isi rumah ( hutang rumah, kereta, makanan, pakaian, lain-lain hutang, belanja sekolah anak, belanja taska etc).

Bagaimana nak mulakan Dana Kecemasan?Anda boleh mulakan serendah RM100/200 sebulan pon ( dari tak buat langsung kan?). Terus aje buat pengkreditan terus ke Akaun Simpanan.

Dimana patut saya simpan wang utk Dana Kecemasan?

Simpanlah wang anda ke dalam akaun simpanan yang memberi pulangan yang agak memberangsangkan. Contoh Tabung Haji. Tiada gunanya menyimpan wang bawah bantal atau dlm tabung di rumah. Tanpa pulangan dan ditambah inflasi, simpanan anda semakin menyusut!

Lagi bagus kalau simpanan anda itu susah nak dikeluarkan, contohnya tak perlu guna kad ATM. Bila perlu guna, hanya ke kaunter pada waktu pejabat. Jika tahap displin tinggi, ok jek nak guna akaun simpanan dengan kad ATM.Bila boleh guna Dana Kecemasan?

Ingat, wang ni hanya utk Kecemasan. Kes-kes di bawah ni bukan kecemasan tauu :

- Beli handbag Coach ( erks..syok juga kalau dpt 1 :p)

- Beli kasut Clarks

- Pergi melancong / bercuti

Selamat membuat Dana Kecemasan anda! Yang dah ada tahniah diucapkan :D

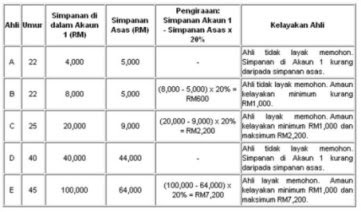

Panduan pengeluaran wang KWSP untuk pelaburan

Mungkin ramai dah tahu bahawa kita boleh keluarkan duit KWSP untuk tujuan pelaburan. Saya berkongsi semula maklumat ni untuk sesiapa yg mempunyai berhasrat nak melabur tapi duit tunai belum ada yg lebih, jadi bolehla anda pilih wang KWSP untuk tujuan ini.

Caranya mudah saja. Anda hanya perlu semak jumlah kelayakan untuk melabur, isi borang dan perunding unit amanah yang akan menghantar borang tersebut.Bagaimana nak semak jumlah yg layak untuk melabur? Ada 2 cara mudah:

1) Melalui i-akaun dlm laman web www.kwsp.gov.my. Amaun kelayakan pengeluaran utk pelbagai tujuan ada dipaparkan. Klik saja link 'kelayakan pengeluaran' seperti di imej bawah, mudah kan?

2) Semakan penyata baki akaun 1. Dan buat kiraan menggunakan formula berikut:

Baki akaun 1-Simpanan Asas mengikut umur ( sila lihat jadual bawah) X 20%Jika amaun yang lebih RM1,000, ini bermakna anda layak melabur.

Jadi, sekarang kita semua ada ada pilihan untuk pelbagaikan simpanan. Hanya anda

Tips menggandakan wang pelaburan : compounding return

A savings without a mission is a rubbish

Jadi, pernahkan anda menilai pulangan simpanan / pelaburan anda? Adakah simpanan anda mempunyai matlamat? Saya kira pasti ada bukan?

Setiap individu mahukan pulangan dr simpanan dan pelaburan yg dibuat. Mari kita belajar tentang 'Compounding Return', ia bermaksud pulangan yang diterima dr pelaburan +dan termasuk pulangan terdahulu.

Lebih lama kita melabur, lebih banyak pulangan akan diperolehi. Tak percaya? Let's do the math.

Untuk contoh di bawah ini, katakan,

Ali melabur RM5,000 pada tahun pertama ke dalam sebuah akaun pelaburan. Dan dia membiarkan saja wangnya disitu tanpa membuat apa-apa. Dia biar saja wangnya selama 15 tahun. Dengan kadar keuntungan purata 8% setiap tahun, dia akan memperoleh RM146, 621. Banyak bukan? Itu hanya contoh yg sempoi. Bayangkan kalau anda melabur RM10,00/ RM20,00/ RM50,000? Lagi dahsyat pulangannya.

Untuk contoh di bawah ini, katakan,

Ali melabur RM5,000 pada tahun pertama ke dalam sebuah akaun pelaburan. Dan dia membiarkan saja wangnya disitu tanpa membuat apa-apa. Dia biar saja wangnya selama 15 tahun. Dengan kadar keuntungan purata 8% setiap tahun, dia akan memperoleh RM146, 621. Banyak bukan? Itu hanya contoh yg sempoi. Bayangkan kalau anda melabur RM10,00/ RM20,00/ RM50,000? Lagi dahsyat pulangannya.

Tips bagi menggandakan wang pelaburan anda dengan keajaiban 'compounding return':

1) Jangan belanja pulangan tersebut!

Untuk memastikan 'compounding return' sentiasa diperoleh dr pelaburan anda, jangan dibelanja setiap pulangan tahunan anda perolehi. Haii..kalau asik belanja mmg tak kaya-kaya. Biarkan sahaja keuntungan pelaburan di situ dan lihat berapa banyak ia akan berkerja utk anda. Dari tahun ke tahun akan datang, anda akan dapat melihat wang tersebut bekerja utk anda, dan ianya adalah 'passive income' kerana anda dah tak perlu buat apa-apa utk gandakannya. Hanya melabur, ingat objektif pelaburan dan duduk diam-diam.

2) Melabur untuk jangka masa panjang.

Hasil compounding return' hanya dapat dilihat dalam jangka masa panjang, bukan pendek!

3) Melabur seawal yg mungkin.

Orang yang melabur lebih awal, akan untung lebih awal! Kalau nak mula sejak lahir pon dah boleh tau. Usah berlengah lagi wahai kawan-kawan..

4) Bila ada wang lebih, tambah pelaburan anda

2) Melabur untuk jangka masa panjang.

Hasil compounding return' hanya dapat dilihat dalam jangka masa panjang, bukan pendek!

3) Melabur seawal yg mungkin.

Orang yang melabur lebih awal, akan untung lebih awal! Kalau nak mula sejak lahir pon dah boleh tau. Usah berlengah lagi wahai kawan-kawan..

4) Bila ada wang lebih, tambah pelaburan anda

Understanding REITs

What is a Real Estate Investment Trust (REIT)?

A REIT is a collective investment scheme that invests primarily in income-producing real estate assets such as shopping centers, offices, warehouses and hotels. To qualify as a REIT, a fund must have most of its assets and income tied to real estate investment and must distribute at least 90% of its total income to unit holders annually. In Malaysia, REITs are exempted from corporate tax if it distributes at least 90% of its total income.

Who is unit holders?

Every investor (like us) who invest into REITs are called unit holders, and entitled to receive income distributions (dividend).

Why invest in REITs?

REITs typically provide high income distribution (currently, 6-10% annually) plus the potential capital appreciation. Comparing 3-4% fixed deposit rate, REITs dividend yield is definitely better.

How to invest in REITs?

One can buy units in any REIT, which is listed on Bursa Malaysia, just like normal stocks trading.

Differences between REITs and Unit Trust?

Direct vs Indirect investment. Almost the same.

How often REITs makes an income distribution?

It depends on respective REITs, usually semi-annually or quarterly.

What is the Tax treatment of unit holders?

Withholding tax will be deducted for distributions made to the following categories:

Risks involved in Malaysia REIT...

- Low liquidity

- Unfavorable interest rate environment

- Deflation and Devaluation of assets

Finance Malaysia's view:

Generally, REIT is suitable for everyone (young, experienced, rich, resourceful, professional...) because it is an hassle-free exposure to real estate investment. Finance Malaysia hopes that more players will join the REIT bandwagon in Malaysia, such as IGB (Mid Valley City), IOI Corp, and even AEON's J

5 rules of thumb on M-REIT investing

Unlike other countries, Malaysia REIT (M-REIT) has its own characteristic. Therefore, one has to master the following 5 basic rules before investing in M-REIT.

1. Management

Good asset management team will stand out from the rest, in case, there is a property bubble. There is cycle in real-estate industry, where required REIT managers to examine and act accordingly. For those experienced managers, any slowdown in real estate industry provided them the opportunities to enhance the trust portfolio.

2. Comparing dividend yield

The main purpose to invest in REIT is for its stable dividend yield. M-REIT is popular for its high dividend yield, which ranges from 7-9% currently. Of course, each REIT has its own figure due to different type of assets.

3. Choosing underlying assets

There is commercial, industrial, hotel, hospital, shopping mall and plantation REIT in Malaysia. Example, if pandemic flu occurs, hotel and shopping mall based REIT tend to under-perform, while hospital REIT will remain resilient.

4. Market capitalization

Size is the matter for Malaysia REIT, with most of them still commencing less than RM1bil market capitalization. Liquidity could pose a danger for investors to trade. Hopefully, with the emergence of SunReit and CMMT, M-REIT could become more attractive and liquid.

5. Compare with regional REITs

M-REIT tends to lag behind regional REITs, such as Singapore and Hong Kong. By tracking regional REITs, investors could predict the trend of M-REITs. This is because M-REITs are relatively young now.

4 GREEN Ideas for Malaysia

Last weekend, I went up to Genting for relaxing and escape from the warm weather in KL. Wondering how could Malaysians live in such condition in the next decades, if the temperature going up consistently?

Amazingly, when I turn-on the television, a GREEN programme was on-screen. Instead of sleeping, I watched the whole documentary about some great ideas or innovations being researched by scientists in US. The programme highlighting 4 green ideas:

1. Green Insulator

The insulator is made up with a special liquid gel, which could prevent heat transfer up to 350 degree Celsius. It can be applied in the glass (transparent) of any building, to bring the sun light in, without heating the interior. We can expect 20% energy saving from air-conditioner and lightnings.

We heard of the this idea long time ago, where people planting on the roof.

- it could absorb heat from entering the building.

- it could release fresher air back to environment just like jungle did.

- it is definitely better aura than concrete jungle.

In view of the decreasing food supply nowadays, planting vegetables or fruits above the roofs can be a good business.

- it could absorb heat from entering the building.

- it could release fresher air back to environment just like jungle did.

- it is definitely better aura than concrete jungle.

In view of the decreasing food supply nowadays, planting vegetables or fruits above the roofs can be a good business.

I like this kind of technology which could bring the free flowing sun light from outside to inside of the building.

Fiber optic is flexible enough to bend and extend as long as you like. It is natural, no sound, and research show that student study under such light could let them concentrate more on studies.

Fantastic !!!

Fiber optic is flexible enough to bend and extend as long as you like. It is natural, no sound, and research show that student study under such light could let them concentrate more on studies.

Fantastic !!!

As we know, solar panel could turn sun light to generate electricity. But, it is heavy, thick and space consuming. With nanotechnology, scientists converted it into much much smaller solar panel which can be handle easily , and it can cat onto any surface of a building, making the whole building like a power plant. The only shortfall is this kind of green technology is the most expensive.

Malaysia could invite experts from other countries to design and construct using such green technology.

Budget 2011: Goodies for first-time house buyers

First Home Scheme was being introduced by the Government in Budget 2011 as below to encourage home ownership among Malaysians:

- Specially cater for first-time house buyers with monthly household income below RM3,000.

- 100% loan for houses priced below RM220,000.

- 50% stamp duty exemptions on instruments of transfer on houses below RM350,000.

- 50% stamp duty exemptions on loan agreement instruments on houses below RM350,000.

To facilitate the 100% loan, Cagamas Bhd (national mortgage corporation) will provide guarantee on the 10% down-payment to eligible house buyers.

Signals sent-out by Government:

1. Enabling first-time buyers to afford their first home.

2. Developers should build more houses which is affordable for such categories.

Advise to first-time house buyers:

1. The securing of such a loan is still subject to how much the banker willing to lend you.

2. 100% loan means higher monthly repayment for borrower.

3. Always buy within your means, not because of such scheme.

How about the buzzing higher down-payment ratio?

Although Government does not raising the down-payment to 20% or 30%, I believe it will announce later. The interesting part is always follows later.

When is the BEST time to buy House? (25 Apr 2011)

Last year 2010, Malaysia property market recorded the BEST year ever. Will it be another record breaking year in 2011? Many economist and property analysts opine that this year, the property market will appreciates by another 10-15%. So, should we wait some more?

Recently, many of my friends keeps on asking the same bold questions.

- Should I buy house now?

- Or, should I wait some more?

- But, when is the property downturn?

|

| Modern Design: Swimming pool in the house. |

Good questions though, but if you ask me when is the property downturn, I really do not know. As a rule of thumb, I will rely on the stock market to give me the indication. Commonly, property market will take a blow one year after the crashing of stock market. Example, the 2008 financial crisis gave us a good timing to invest in property market. For those who buy house during that time, you should know what I am talking about and smile.

So what? How about now?

Extractions from BNM monetary policy statement

As expected, Bank Negara Malaysia (BNM) decided to maintain the Overnight Policy Rate (OPR) at 2.75% yesterday. This was the 3rd time in a row that BNM left it unchanged. Are there any hints by BNM on Malaysia's economy this year? We can explore the "hidden messages" from the monetary policy statement as below:

Regional Front:

- While advanced economies continue to register modest growth, most emerging economies have experienced strong growth.

- For Asian region, domestic economic activity continues to support the growth momentum amid weaker external demand.

- Shifts in global liquidity have resulted in significant capital flows into the emerging economies, in particular, Asian region, and have brought with it risks to macroeconomic and financial stability.

- The region is also being affected by global inflationary pressure arising from the higher commodity and food prices.

- Recent indicators point towards a sustained expansion in private sector activity.

- External demand, however, was affected by the slower global growth.

- Malaysian economy is expected to grow at a steady pace in 2011, underpinned by continue firm expansion in domestic demand.

- Private consumption will be supported by sustained employment and income growth.

- Private investment activity will be supported by domestic-oriented sectors and the expansion of new growth industries.

On Inflation:

- Domestic headline inflation rose towards the end of 2010 albeit remained low at 2.2%.

- The increased was mainly on account of higher food and energy prices.

- Prices are expected to increase at a modest pace in the coming months, driven primarily by rising global commodity and food prices.

- The assessment is that inflation will continue to be driven by supply factors with limited evidence of excess demand exerting pressure on prices.

BNM Conclusions:

- BNM considers the current monetary policy stance as appropriate and consistent with current assessment of the economic growth and inflation prospects.

- The stance continues to remain accommodative and supportive of economic growth.

- Going forward, additional policy tools such as the statutory reserve requirement (SRR) and macro-prudential lending measures may be considered to avoid the risks of macroeconomic and financial imbalances.

- We expected inflation to rise at a faster pace in 2011

- BNM to continue hiking interest rate in second-half 2011

- OPR potentially be raised by 50-75 basis points to 3.25-3.50%

- Bank's loan growth will slow if SRR was raised

For full BNM monetary policy statement, click here.

2011 Malaysia Outlook

2011 Malaysia Outlook: Sunshine to Sunset

By Finance Malaysia,

Driven by better economy prospects, Malaysia successfully escape recession two years ago, particularly March 2009. Strong GDP growth and numerous government's initiatives is the main reason why local market experiencing a spectacular run-up since then. Today, our KLCI break another record high, by closing at 1551.89 points. So, what is the outlook for Malaysia in 2011?

|

| Maybank expects KLCI will hit 1,700 mark in 2011 |

KLCI

The Malaysia Index will continue to perform in line with the overall economy. More IPO will be issue. More merger & acquisitions activities will be seen. KLCI will be driven by the following factors:-

- Improving sentiment

- Follow through momentum from all time high

- Hot capital inflows

- Improving liquidity

- Boost by plantation and oil & gas heavyweights, such as IOI, Sime and PetroChem

- Finance sector will continue to do well in line with the economy

- 2011 will be a "Grammy Awards" show for construction sector, where government rolling out its multi-billion projects

- Another show is from oil & gas sector, organized by Petronas

- Property sector should continue chalking up sales with great demand

Sunshine to Sunset sector(s)...

Please take note that all is not so bright in 2011. Some of these sectors could face some turbulence in 2nd half of 2011. That's why I called it "Sunshine to Sunset".

- Once high-flyers in difficult times, glove sector could be facing another whirlwind quarters with excess capacity and high input costs in the second half.

- Besides glove, manufacturing sector would struggle because of electricity tariff hike imposed by TNB, speculating after Chinese New Year.

- Technology sector will be a sunset sector next year due to stronger ringgit.

Bond market

Local bond market will boom, in conjunction with the projects awarding sessions and government's ambition to make Malaysia an Islamic financial hub. Local bond market will do well in the first half, before Bank Negara Malaysia resume its interest rate hiking policy later.

Tax Benefits of Unit Trusts YOU Must Know

Due to Malaysian Government's efforts to promote unit trusts, most of the income received by unit trusts will be exempt from income tax. Basically, the income of unit trust may consist of dividends, interest or profit and gain from sale of investments and returns on bonds. Then, the income is assessed and charged to tax separately from the income of unit holders, which was governed by the Income Tax Act

Gains on disposal of investments by unit trust will not be subject to income tax. The only exception is where the investments represent real properties which could be subject to real property gains tax (RPGT).

Exempt Income

Interest and discount derived by unit trusts from the following types of investments is exempt from income tax:

- Securities or bonds issued or guaranteed by the Government

- Debentures, other than convertible loan stocks, approved by the Securities Commission

- Bon Simpanan Malaysia issued by Bank Negara Malaysia

- Interest paid or credited by any bank or financial institution

- Income from overseas investment is also exempted from Malaysian tax

Such dividends would already have tax credits attached to them and can be used to offset against the unit trust's tax liabilities. Therefore, either of the following will happen:-

- NO further tax applicable

- If the unit trust's tax liability is less than the tax credits, the tax credits attached to dividends can be refunded to unit trust

Example, a corporate investor were to deposit funds in a fixed deposit, the interest will be subjected to corporate tax of 25% currently. But, unit trusts are specifically tax exempted on interest on fixed deposits. In other words, fixed income and money market funds should be an 'Angel Fund' for corporate investors.

Revised EPF approved funds effective 1 Sept 2010

Effective 1 September 2010, there are 223 unit trust funds approved under the EPF Members Investment Scheme (EPF-MIS). The list of EPF approved funds is updated upon conducting the fund evaluation exercise based on EPF-MIS fund evaluation methodology (FEM).

Under the FEM, funds must meet the set standard criteria, including:-

- At least 3-years track records

- Have investment mandate of not exceeding 30% in overseas assets

- Consistency in return performance among peers/ with benchmark

By using an international research house rating data as input in the assessment and evaluation of funds, the exercise will be conducted once a year.

Suspended Funds?

Funds that underperformed their peers will be suspended, until they are qualified to be reinstated. Suspended funds are not allowed to received new investment under the EPF-MIS, yet investments made by investors prior to the suspension are nevertheless allowed to remain in the funds.

Suspended Funds are loss-making funds?

Not necessary. FEM is just a measure of relative performance, as suspended funds may still generate strong profits, but not as high as their peers.

Please click "EPF approved funds" for the list of 223 funds.

3 wrong perceptions on Malaysia's Properties

Wrong perception #1:

Malaysia's properties still attractive?

No doubt, many analysts and researchers comment that the local market price is still low if comparing to regional markets, such as Singapore and Hong Kong. This was wrong because we cannot simply compare with islands, where land is limited. We cannot simply compare with China, where billions of people chasing for limited supply of houses.

Wrong perception #2:

KL Developers are going high-end?

Yup… KL developers are focusing at launching those high-end residential units. But, do not come into conclusion just that. First, we must look into the locations of these new launches, especially those at golden triangle. Locations play a vital role of setting the price of properties. Second, the cost of acquiring a particular land, and the cost of constructing sure will add to the price where buyers have to bear. Third, I noticed that many super high-end units are located on hills top. Difficulties to get the relevant approvals and moving machines up there was included into the selling price of course. Though, I can't deny there are developers trying to mark-up the price, as buyers think that the costlier the better.

|

| The Pearl @ KLCC |

Malaysians household debt is high because of house loan?

Generally, house loan could easily be our biggest "earning-eater". House installments eat into our monthly salary. While there is good debt and bad debt, I categorized property as good and car loan as bad debt. Malaysians high household debt is caused by the high car price, which is not worth to have if comparing with a house. And, my previous article "Proton loves Perodua to avoid extinction?" highlighted the problems of local car industry which directly affecting our daily lives.

New Deposit Insurance Limit At RM250,000

Effectively today (31st December 2010), the deposit insurance limit will be increased to RM250,000 per depositor per bank, announced Perbadanan Insurans Deposit Malaysia (PIDM).

Below is the summary of the said announcement:-

- The new PIDM Bill 2010 has been passed in Parliament.

- The limit of RM250,000 will protect 99% of retail depositors in full.

- Under the new Bill, foreign currency depositors will now enjoy deposit insurance protection.

- The enhanced financial consumer protection package also includes the expansion of PIDM's mandate to include the administration of the Takaful and Insurance Benefits Protection System (TIPS).

- Licensed insurance companies and registered Takaful operators will automatically become member institutions of PIDM.

- PIDM was given the powers to intervene in or resolve troubled insurer members and ensure prompt payments to claimants.

Source: www.pidm.gov.my

Public Mutual ?

cara yg selamat dan halal utk mengandakan wang anda!!!

satu alternatif kpd ASB!!!ramai org kita hanya tahu pasal ASB… w/pon dividen+bonus nya ciput …org melayu memang berminat , no wonder ada 60 BILLION kat ASB!!!

public mutual ada menyediakan dana-dana islamic yg buleh tahan performance dia compare with konvensiona(HARAM)l!!

tapi sejak lehman bro. jatuh muflis, dan menyebabkan pasaran saham merudum …minat melayu terhadap saham amanah pon jatuh merudum …

ini disebabkan agen-agen yg ‘liar’ hanya mencari pelabur utk jangkamasa yg singkat !!!

hanya cerita untung,bila dana public mutual jatuh 35% ,muka pon tak nampak, resign laa…

sepatutnya PELABURAN UNIT AMANAH UTK JANGKAMASA PANJANG 3-5TAHUN!!

tahun 2000-2008…prestasi public mutual amat memberansangkan, sehingga buleh memberi pulangan 15-77% setahun!!!

tetapi jika mendapat maklumat yg tepat , para pelabur tak perlu risau ,

tahun 2008-2009 nilai merudum ,sepatutnya ditambah @mula melabur kerana harganya murah!!

tahun 2010,2011dan 2012 hasil pelaburan tadi dapat dilihat !!!

unit amanah mengenakan caj permulaan sebanyak 5.5%….

contoh : pelaburan 10,000.00

hanya 9540 sahaja duit itu digunankan rm550 lagi hilang sebagai caj !!!

tetapi 550 tu sekali shaja…jika kekal melabur utk 10thn rm55 je setahun …

masuk je dah rugi 5.5% !!!

tapi tgk prestasi utk 3-5 thn …hasilnya lebih dari ASB,tabung haji ….

setakat itu dululah intro …

soalan 1

jadi, 5.5% sthn sekali sahaja utk public mutual ni ( satu jenis dana ).

maknaya kalau dividen diisytiharkan 15%, – 5.5% = 9.5% dividen sebenarnya, tul tak dbe80?

JAWAPAN!

KURANG TEPAT

contoh:Ali melabur rm10K dgn public mutual melalui dana PIDF pada 31/12/2009

masuk rm10K…

real money invested rm9450

public islamic dividen fund(PIDF)

harga semasa masuk rm0.25 seunit

so, 9450/0.25= 37,800 unit dapat!!!

pada 31/5/2010,tahun kewangan berakhir, public mutual declare agihan dividen 5sen seunit !

RM0.05 X 37800=rm1890!!

1890/9450=20%!!!

tu baru dividen yg diishtihar!!!

satu lagi ‘capital gain’

pada 30/4/2010 harga seunit PIDF rm0.30 (sila klik http://www.publicmutual.com.my/ )daily fund price

maka, 37,800 X rm0.30 =11340 , untung 20%

nilai semasa saham anda!!

bagi agen yg berkaliber mcm saya, ada melanggan “CAMS”!!! satu software khas utk agen…

maklumat ini akan diupdate 2kali seminggu…

utk tujuan monitor perkembangan semasa harga unit amanah pelabur saya…

unit amanah adalah satu makenisme pengumpulan duit ‘money pool’ yg sah dan berlesen yg mengutip wang dari rakyat malaysia dan asing…

contohh:

dana public ittikal menpunyai Nilai aset bersih rm3billion,

jadi semua yg berminat nak melabur unit amanah ini akan dimasukkan ke dalam dana ini.

tetapi jika kutipan sudah cukup rm3billion, public mutual terpaksa mengemukan permohonan baru kpd suruhanjaya sekuriti(SC) utk menambah NAB ini kepada 4bilion.

kemudian, dana ini akan dilaburkan di dalam pasaran saham malaysia dan luar negara, syarikat tak tersenarai,bond, sukuk dan macam-macam lagi seperti termaktub di dalam persektus dana.!!!

Dana yg berjumlah berbillion ini akan diuruskan secara profesional oleh pengurus dana public mutual!!!

kelebihan unit amanah berbanding pelabur persendirian yg melabur di bursa malaysia ;

1. diuruskan oleh pengurus dana yg berpengalaman luas,berpedidikan tinggi(expert),profesional,

2.nilai wang rm1000 berkuasa seperti rm3billion-

w/pom melabur rm1000 di public ittikal tetapi wang yg terkumpul di dalam dana ini (rm3billion) akan masuk pasaran saham,sukuk, bond. sesuatu yg mustahil utk wang rm1000 melakukanya.

3. pengagihan risiko, dgn hanya rm1000 pelabur persendirian hanya dapat 1 lot saham syarikat tertentu sahaja,tetapi dgn public mutual rm1000, dapat banyak syarikat, jika saham satu syarikat jatuh, habis lah anda, tetapi tidak dgn unit amanah.

risiko terdapat

a. risiko serantau, bursa malaysia merudum, bursa singapore pon merudum, tetapi hong kong ,japan , australia,us, canada, mungkin tidak …

b. risiko khusus, syarikat yg menjalankan bisness khusus, seperti MAS,airasia, terjejas dgn wabak H1N1, selesema burung …akan mengalami penurunan, tetapi tidak bagi syarikat lain..

4. peluang utk mendapat pulangan modal ‘capital gain’ di samping dividen dan bonus.

dgn unit amanah pelabur jugo berpeluang mendapat ini semua. bukan fix mcm ASB beli rm1, jual rm1…

tetapi awas nilai nya juga mungkin berkurang! jgn dok asyik fikir unit amanah naik je memanjang !!!tu yg panik bila unit amanah muram 2008-2009!!

bila dah paham semua nie baru jadi pelabur yg bijak…

disamping berlesen dan sah unit amanah juga dipantau oleh pemegang amanah ‘trustee’ ,pihak ketiga (tiada kiatan dgn public mutual, even public bank)

pelabur bagi duit ke publlic mutual (Pittikal),pittikal dapat duit rm2billion, diuruskan oleh pengurus dana yg berpengalaman dan profesional…

pemagang amanah(pihak ketiga) Amanah Raya akan menjaga,memantau duit rm2billion tu bagi pihak pelabur,berdasarkan perjanjian seperti termaktub di dalam perpektus dana.

contoh : jika perpektus menyatakan dana ini hanya buleh melabur di malaysia sahaja, maka jika pengurus dana ingin melabur di taiwan,hong kong adalah menjadi satu kesalahan..

sila klik

#mce_temp_url#

utk tgk contoh isi kandungan CAMS pelaburan saya !

saya melabur melalui skim KWSP pada 2008! terkini 29/21/2009 dah dapat 20.14%

dana yg layak utk epf, saya cadang PUBLIC ISLAMIC DIVIDEN FUND(PIDF)

UTK dana mana yg layak

sila klik

#mce_temp_url#

kalau epf ,masuk sekarang ,umur 55 baru kita dapat kontrol duit tu !!

sekarang epf regulation based on umur

umur Min akaun 1

25 RM9000

26 RM11000

27 RM12000

28 RM14000

29 RM16000

30 RM18000

31 RM20000

Utk umur lain rujuk link d bawah:

#mce_temp_url#

contoh : Ali umur 30tahun , simpanan kat akaun 1 RM35,000.00

maka; 35000 – 30000= 5000

5000 X 20% =rm1000.00

jadi layak keluar 20% dari baki akaun 1 bersamaan rm1000.00

next 3 months layak keluar lagi , 20% dari baki semasa!

jika umur 30 thn , ada masa 25 thn utk dana buat untung!

mengikut rekod yg lepas (masa depan tak janji )

pulangan 3 thn 25%,

5 tahun 77 %

10 tahun 120%!!

maka pada umur 40thn ,pelabur buleh switch masuk epf balik !!!

dah dapat 120% kan compare epf 55% utk 10tahun…

switch nie anytime sebenarnya buleh buat …dah dapat target berapa nak untung melalui public mutual ,masuk balik epf !!!

sama je duit tu pelabur hanya buleh tengok je …umur 55 baru dapat!!

jawapan

biasanya caj pengurusan sekitar(management fee) 3-5%!semua caj akan di nyatakan di dalam laporan tahunan & perseptus !semua jelas …tetapi caj ini ditolak dari nilai aset bersih (NAV) dana…contoh nav pada 30/12/09 rm0.30 caj pengurusan rm200,000.00maka nav akan menjadi rm0.2888 selepas seminggu , sebulan nav akan menjadi rm0.2900 bergantung kpd pengurus dana yg mengurus pelaburan.pelabur tidak merasa kesan lansung dari caj pengurusan ini.jika e-statement menunjuk untung 20.14% itu setelah ditolak caj caj tadi !!servis caj@ caj perkhidmatan setiap kali melabur je yg paling terasa…seperti di ulas dlm posting terdahulu…management fee, trustee fee, auditor fee dan mcm lagi feee tu hanya utk pengetahuan kita sahaja…itu dikira kos utk mengandakan duit kita …jika kita dah expert tak perlu medium public mutual lagi sebagai salah satu sumber pelaburan….tetapi di unit amanah segala macam kos akan dinyatakan dgn jelas kepada para pelabur!kos percetakan laporan tahun pon ada dinyatakan.

memang pening …saya present 3-4 kali pon pelabur masih penin!!

last-last saya cakap wang anda selamat dan berganda !

service caj 5.5% utk cash investment! epf skim hanya 3% ! ada beza di sana…

setiap kali melabur tu yg penting utk pelabur!

seperti contoh dahulu jika 10000 hanya 9450 utk melabur

yuran tahunan tu tolak nav !!!kos sampingan!

bila dana tu ‘bagus’ yuran tahunan tak terasa!!!

ia dikira perbelanjaan dana utk bagi 10-77% setahun untung!!!

memang laa jika compare dgn ASB,fix deposit ,tabung haji TIADA YURAN TAHUN!

tetapi pulangan nya CIPUT!!!

service caj adalah utk public mutual bayar kpd agen-agen (komisen)

kira ciput jugak komisen unit amanah compare dgn insurans!

tetapi tgk pada sales!!

jika sales 10,000 sebulan rm275 je …tetapi jika sebulan dapat sales rm30juta

rm9++ ribu sebulan ….think +ve !

ada career benefit lagi + year end bonus…

itu yg menyebabkan agen seronok tu ….

so ,jelas kenapa unit amanah kenakan caj permulaan 3% , 5.5% dsb

tetapi sepertiyg dinyatakan terlebih dahulu …

3% dan 5.5% nie sekali, jika kekal 10 tahun …hanya 0.55% setahun ,untung 120% !!!!

TEPUK DADA , FIKIR!!BERTINDAK…

jika tidak ,anda hanya begitu sahaja….ada peluang ,risiko, biarkan

duit 1000 anda di simpan di bank pada 2010 menjadi rm1100 pada 2020!

tetapi di unit amanah rm2500!!

baru bijak !!

tetapi ramai di antara kita membiarkan peluang sebegini apabila unit amanah dgn lesen dan sah dan hala ( tentunya ada pelbagai caj)!

tetapi apabila di tawarkan dgn skim cepat kaya mudah terpedaya!!

tanpa caj, hanya untung 20% sebulan ditawarkan , ramai yg setuju!

siap buat personal loan bank lagi !!!

fikir!

dari mana skim dapat jana keuntungan 20% sebulan jika betul-betul bisness!!

apa jenis bisness dapat buat untung 20% sebulan selama 24bulan!!!

hanya dgn ilmu dan sabar dapat menahan gelora di dada

satu alternatif kpd ASB!!!ramai org kita hanya tahu pasal ASB… w/pon dividen+bonus nya ciput …org melayu memang berminat , no wonder ada 60 BILLION kat ASB!!!

public mutual ada menyediakan dana-dana islamic yg buleh tahan performance dia compare with konvensiona(HARAM)l!!

tapi sejak lehman bro. jatuh muflis, dan menyebabkan pasaran saham merudum …minat melayu terhadap saham amanah pon jatuh merudum …

ini disebabkan agen-agen yg ‘liar’ hanya mencari pelabur utk jangkamasa yg singkat !!!

hanya cerita untung,bila dana public mutual jatuh 35% ,muka pon tak nampak, resign laa…

sepatutnya PELABURAN UNIT AMANAH UTK JANGKAMASA PANJANG 3-5TAHUN!!

tahun 2000-2008…prestasi public mutual amat memberansangkan, sehingga buleh memberi pulangan 15-77% setahun!!!

tetapi jika mendapat maklumat yg tepat , para pelabur tak perlu risau ,

tahun 2008-2009 nilai merudum ,sepatutnya ditambah @mula melabur kerana harganya murah!!

tahun 2010,2011dan 2012 hasil pelaburan tadi dapat dilihat !!!

unit amanah mengenakan caj permulaan sebanyak 5.5%….

contoh : pelaburan 10,000.00

hanya 9540 sahaja duit itu digunankan rm550 lagi hilang sebagai caj !!!

tetapi 550 tu sekali shaja…jika kekal melabur utk 10thn rm55 je setahun …

masuk je dah rugi 5.5% !!!

tapi tgk prestasi utk 3-5 thn …hasilnya lebih dari ASB,tabung haji ….

setakat itu dululah intro …

soalan 1

jadi, 5.5% sthn sekali sahaja utk public mutual ni ( satu jenis dana ).

maknaya kalau dividen diisytiharkan 15%, – 5.5% = 9.5% dividen sebenarnya, tul tak dbe80?

JAWAPAN!

KURANG TEPAT

contoh:Ali melabur rm10K dgn public mutual melalui dana PIDF pada 31/12/2009

masuk rm10K…

real money invested rm9450

public islamic dividen fund(PIDF)

harga semasa masuk rm0.25 seunit

so, 9450/0.25= 37,800 unit dapat!!!

pada 31/5/2010,tahun kewangan berakhir, public mutual declare agihan dividen 5sen seunit !

RM0.05 X 37800=rm1890!!

1890/9450=20%!!!

tu baru dividen yg diishtihar!!!

satu lagi ‘capital gain’

pada 30/4/2010 harga seunit PIDF rm0.30 (sila klik http://www.publicmutual.com.my/ )daily fund price

maka, 37,800 X rm0.30 =11340 , untung 20%

nilai semasa saham anda!!

bagi agen yg berkaliber mcm saya, ada melanggan “CAMS”!!! satu software khas utk agen…

maklumat ini akan diupdate 2kali seminggu…

utk tujuan monitor perkembangan semasa harga unit amanah pelabur saya…

unit amanah adalah satu makenisme pengumpulan duit ‘money pool’ yg sah dan berlesen yg mengutip wang dari rakyat malaysia dan asing…

contohh:

dana public ittikal menpunyai Nilai aset bersih rm3billion,

jadi semua yg berminat nak melabur unit amanah ini akan dimasukkan ke dalam dana ini.

tetapi jika kutipan sudah cukup rm3billion, public mutual terpaksa mengemukan permohonan baru kpd suruhanjaya sekuriti(SC) utk menambah NAB ini kepada 4bilion.

kemudian, dana ini akan dilaburkan di dalam pasaran saham malaysia dan luar negara, syarikat tak tersenarai,bond, sukuk dan macam-macam lagi seperti termaktub di dalam persektus dana.!!!

Dana yg berjumlah berbillion ini akan diuruskan secara profesional oleh pengurus dana public mutual!!!

kelebihan unit amanah berbanding pelabur persendirian yg melabur di bursa malaysia ;

1. diuruskan oleh pengurus dana yg berpengalaman luas,berpedidikan tinggi(expert),profesional,

2.nilai wang rm1000 berkuasa seperti rm3billion-

w/pom melabur rm1000 di public ittikal tetapi wang yg terkumpul di dalam dana ini (rm3billion) akan masuk pasaran saham,sukuk, bond. sesuatu yg mustahil utk wang rm1000 melakukanya.

3. pengagihan risiko, dgn hanya rm1000 pelabur persendirian hanya dapat 1 lot saham syarikat tertentu sahaja,tetapi dgn public mutual rm1000, dapat banyak syarikat, jika saham satu syarikat jatuh, habis lah anda, tetapi tidak dgn unit amanah.

risiko terdapat

a. risiko serantau, bursa malaysia merudum, bursa singapore pon merudum, tetapi hong kong ,japan , australia,us, canada, mungkin tidak …

b. risiko khusus, syarikat yg menjalankan bisness khusus, seperti MAS,airasia, terjejas dgn wabak H1N1, selesema burung …akan mengalami penurunan, tetapi tidak bagi syarikat lain..

4. peluang utk mendapat pulangan modal ‘capital gain’ di samping dividen dan bonus.

dgn unit amanah pelabur jugo berpeluang mendapat ini semua. bukan fix mcm ASB beli rm1, jual rm1…

tetapi awas nilai nya juga mungkin berkurang! jgn dok asyik fikir unit amanah naik je memanjang !!!tu yg panik bila unit amanah muram 2008-2009!!

bila dah paham semua nie baru jadi pelabur yg bijak…

disamping berlesen dan sah unit amanah juga dipantau oleh pemegang amanah ‘trustee’ ,pihak ketiga (tiada kiatan dgn public mutual, even public bank)

pelabur bagi duit ke publlic mutual (Pittikal),pittikal dapat duit rm2billion, diuruskan oleh pengurus dana yg berpengalaman dan profesional…

pemagang amanah(pihak ketiga) Amanah Raya akan menjaga,memantau duit rm2billion tu bagi pihak pelabur,berdasarkan perjanjian seperti termaktub di dalam perpektus dana.

contoh : jika perpektus menyatakan dana ini hanya buleh melabur di malaysia sahaja, maka jika pengurus dana ingin melabur di taiwan,hong kong adalah menjadi satu kesalahan..

sila klik

#mce_temp_url#

utk tgk contoh isi kandungan CAMS pelaburan saya !

saya melabur melalui skim KWSP pada 2008! terkini 29/21/2009 dah dapat 20.14%

dana yg layak utk epf, saya cadang PUBLIC ISLAMIC DIVIDEN FUND(PIDF)

UTK dana mana yg layak

sila klik

#mce_temp_url#

kalau epf ,masuk sekarang ,umur 55 baru kita dapat kontrol duit tu !!

sekarang epf regulation based on umur

umur Min akaun 1

25 RM9000

26 RM11000

27 RM12000

28 RM14000

29 RM16000

30 RM18000

31 RM20000

Utk umur lain rujuk link d bawah:

#mce_temp_url#

contoh : Ali umur 30tahun , simpanan kat akaun 1 RM35,000.00

maka; 35000 – 30000= 5000

5000 X 20% =rm1000.00

jadi layak keluar 20% dari baki akaun 1 bersamaan rm1000.00

next 3 months layak keluar lagi , 20% dari baki semasa!

jika umur 30 thn , ada masa 25 thn utk dana buat untung!

mengikut rekod yg lepas (masa depan tak janji )

pulangan 3 thn 25%,

5 tahun 77 %

10 tahun 120%!!

maka pada umur 40thn ,pelabur buleh switch masuk epf balik !!!

dah dapat 120% kan compare epf 55% utk 10tahun…

switch nie anytime sebenarnya buleh buat …dah dapat target berapa nak untung melalui public mutual ,masuk balik epf !!!

sama je duit tu pelabur hanya buleh tengok je …umur 55 baru dapat!!

soalan ke-3

berapa % setahun utk uruskan danajawapan

biasanya caj pengurusan sekitar(management fee) 3-5%!semua caj akan di nyatakan di dalam laporan tahunan & perseptus !semua jelas …tetapi caj ini ditolak dari nilai aset bersih (NAV) dana…contoh nav pada 30/12/09 rm0.30 caj pengurusan rm200,000.00maka nav akan menjadi rm0.2888 selepas seminggu , sebulan nav akan menjadi rm0.2900 bergantung kpd pengurus dana yg mengurus pelaburan.pelabur tidak merasa kesan lansung dari caj pengurusan ini.jika e-statement menunjuk untung 20.14% itu setelah ditolak caj caj tadi !!servis caj@ caj perkhidmatan setiap kali melabur je yg paling terasa…seperti di ulas dlm posting terdahulu…management fee, trustee fee, auditor fee dan mcm lagi feee tu hanya utk pengetahuan kita sahaja…itu dikira kos utk mengandakan duit kita …jika kita dah expert tak perlu medium public mutual lagi sebagai salah satu sumber pelaburan….tetapi di unit amanah segala macam kos akan dinyatakan dgn jelas kepada para pelabur!kos percetakan laporan tahun pon ada dinyatakan.

memang pening …saya present 3-4 kali pon pelabur masih penin!!

last-last saya cakap wang anda selamat dan berganda !

service caj 5.5% utk cash investment! epf skim hanya 3% ! ada beza di sana…

setiap kali melabur tu yg penting utk pelabur!

seperti contoh dahulu jika 10000 hanya 9450 utk melabur

yuran tahunan tu tolak nav !!!kos sampingan!

bila dana tu ‘bagus’ yuran tahunan tak terasa!!!

ia dikira perbelanjaan dana utk bagi 10-77% setahun untung!!!

memang laa jika compare dgn ASB,fix deposit ,tabung haji TIADA YURAN TAHUN!

tetapi pulangan nya CIPUT!!!

service caj adalah utk public mutual bayar kpd agen-agen (komisen)

kira ciput jugak komisen unit amanah compare dgn insurans!

tetapi tgk pada sales!!

jika sales 10,000 sebulan rm275 je …tetapi jika sebulan dapat sales rm30juta

rm9++ ribu sebulan ….think +ve !

ada career benefit lagi + year end bonus…

itu yg menyebabkan agen seronok tu ….

so ,jelas kenapa unit amanah kenakan caj permulaan 3% , 5.5% dsb

tetapi sepertiyg dinyatakan terlebih dahulu …

3% dan 5.5% nie sekali, jika kekal 10 tahun …hanya 0.55% setahun ,untung 120% !!!!

TEPUK DADA , FIKIR!!BERTINDAK…

jika tidak ,anda hanya begitu sahaja….ada peluang ,risiko, biarkan

duit 1000 anda di simpan di bank pada 2010 menjadi rm1100 pada 2020!

tetapi di unit amanah rm2500!!

baru bijak !!

tetapi ramai di antara kita membiarkan peluang sebegini apabila unit amanah dgn lesen dan sah dan hala ( tentunya ada pelbagai caj)!

tetapi apabila di tawarkan dgn skim cepat kaya mudah terpedaya!!

tanpa caj, hanya untung 20% sebulan ditawarkan , ramai yg setuju!

siap buat personal loan bank lagi !!!

fikir!

dari mana skim dapat jana keuntungan 20% sebulan jika betul-betul bisness!!

apa jenis bisness dapat buat untung 20% sebulan selama 24bulan!!!

hanya dgn ilmu dan sabar dapat menahan gelora di dada

soalan ke-4?

sudah berapa saya menceburi bidang ini?

JAWAPAN

lama tak lama jugok since 2006!

nak kata berjaya tak jugak ! slow and steady !

tujuan join public mutual hanya nak dapat ilmu pasal dunia kewangan/ekonomi !!

saya dulu engineer ! pasal pitih nie blank!!zero !

agen insurans cadang beli polisi utk gandakan pitih pon saya beli!!

tetapi setelah saya join public mutual …memang berbaloi ilmu tu …

di masa semua org ‘gila’ dgn skim internet,swiss cash, dinar dsb …

dgn ilmu dari kursus-kursus public mutual saya berjaya mengekang hawa nafsu nak untung cepat!

dan ia benar …penghujung 2008 semua skim tadi lingkup!

dari mana datang untung yg sebegitu jika bukan money game!

so ,kepada peserta forum, jadi pelabur dan become agen pon elok !

tak berjaya sebagai egen dapat buat sales berjuta-juta , ilmu dari kursus,seminar banyak membantu hidup anda !!!

SOALAN KE-5

MACAMMANA NAK JADI AGEN MCM SAYA

JAWAPAN

nak jadi agen simple je !!

1.photocopy ic 2 pcs

2. photocopy sijil spm or diploma,degre 1 copy

3. gambar passport 6pcs

4. yuran rm253!!!di bayar balik jika dapat buat sales rm50000-modal air liur je beb!!

kelas nak jawab examCUTE(computerised unit trust examination)1day!bab ekonomi,kewangan dan mcm mcm ilmu lagi ….nak ganda duit ! ada calculation sikit!

exam 2 jam, sabtu dan ahad !!!seluruh negara

kelas nak cara nak isi borang 1 day

kelas nak buat sales,presentation,approach, 1day…

last sekali ….contact ambo ..join bawah ambo ! for full support, materials,minda,teamwork !!!

buat permulaan just jadi introducer je …biar otai buat persembahan tu !!!persembahan tu mcm topik kat atas tu laaa….

apa unit amanah , apa caj , apa risiko ,

last dividen …BUNOS!!!

duit 10ribu jadi 20 ribu !!!

saya agen fulltime, bos saya pon fulltime ….x ade masalah utk support newbie!!

kursus …semua akan diajar+dibimbing….

keyakinan diri…cara penampilan,cara persembahan,cara nak tepon bakal pelabur semua ado !!!

yg zero pon buleh ,,janji nok beruboh!!!

SOALAN KE-6

APA ITU PUBLICMUTUAL ONLINE

JAWAPAN

publicmutual online!!!

smart way to invest !!!

bila ada akaun dgn public mutual, just visit any branch nationwide!

submit your IC copy and get id+password!!

that’s it !!!

and then u can begin do all transaction with public mutual online!!

buying,switching, repurchase!tranfer without walk -in to public mutual office!!!!

mudah kan …

itulah keistimewaan public mutual !!!

Subscribe to:

Comments (Atom)